If you work in finance or accounts receivable, you may have encountered a request for your business to accept commercial or virtual card as a form of payment. Immediately your mind may go to the overall cost associated with accepting card, or if you already accept them, you may not fully understand what determines how much you pay in fees. Understanding interchange rates is key to ensuring your AR department is operating as cost-efficiently as possible. Here's what you need to know:

What are B2B commercial card payments and how does B2B Interchange work?

B2B card payments refers to the process of facilitating financial transactions between businesses; in this case, credit card payments. Typically, this is the transaction flow and ultimately the interchange that will dictate the cost of the payment:

- Transaction Initiation: A buyer initiates a purchase using a credit card (which could be a virtual card, purchasing card, ghost card, or other card instrument) to pay for goods or services from a supplier.

- Authorization Request: The supplier submits the transaction details to their acquiring bank for authorization. This includes information such as the credit card number, transaction amount, and merchant identification.

- Routing to Card Network: The acquiring bank routes the authorization request to the appropriate card network (e.g., Visa, Mastercard, American Express) based on the type of card used by the buyer.

- Authorization Request: The card network sends the authorization request to the issuing bank, which indicates whether the cardholder has sufficient funds or credit to complete the transaction. If approved, the bank sends an authorization code back to the acquiring bank.

- Interchange Rate Determination: Once the transaction is authorized, the acquiring bank pays an interchange rate to the issuing bank. The interchange rate is determined by the card networks and varies depending on the type of card used, the level of data provided, and the risk associated with the transaction.

- Settlement: After the transaction is authorized and the interchange fee is determined, the acquiring bank settles the transaction with the supplier by depositing the funds into the supplier’s bank account.

- Transaction Completion: The transaction is considered complete once the funds have been transferred to the supplier's account.

What are B2B interchange rates and fees?

Interchange fees are charges paid by the acquirer to the issuing bank for accepting, processing, and authorizing credit card transactions. Interchange fees are set by the card networks and differ depending on transaction method, type of business or industry, size of transaction, and level of data being processed. The purpose of interchange is to cover costs associated with the issuing bank lending the cardholder funds for a period of time and systemic risk.

Different Levels of Payment Processing

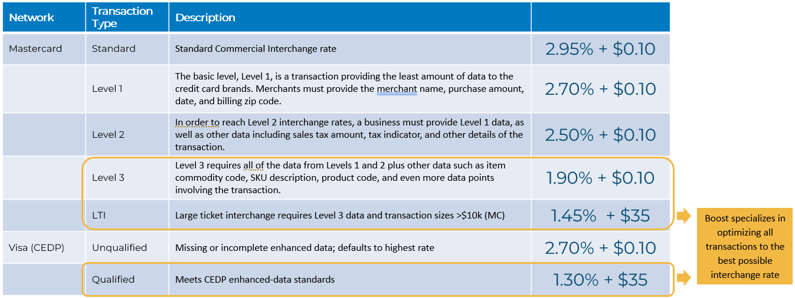

Each card network has its own set of data requirements that determine how a transaction qualifies for interchange. In short, the more complete the transactional data you provide, the lower your interchange costs.

Historically, card networks categorized these requirements into data “levels.” Mastercard still uses this structure, where transactions that include enhanced remittance details qualify for Level 2 or Level 3 interchange, resulting in lower rates.

As of October 17th, 2025 Visa has transitioned away from this model. With the launch of its Commercial Enhanced Data Program (CEDP), Visa replaced the Level 1–3 framework with a new structure that classifies transactions as either qualified or unqualified.

- Qualified transactions meet Visa’s enhanced data standards. Qualified transactions are eligible for the preferred CEDP interchange rates.

- Unqualified transactions are missing one or more data points and default to a higher rate, the standard commercial interchange rates.

While Level 3 interchange, also known as large ticket interchange, remains the lowest publicly available rate for Mastercard transactions, Visa’s lowest publicly available rate now applies to transactions classified as qualified under the CEDP program.

This shift doesn’t eliminate the opportunity for suppliers to reduce costs, it simply changes how data quality is measured. Suppliers that meet Visa’s CEDP criteria can still achieve the lowest possible interchange rates by ensuring all required data fields are included at the time of processing.

For a deeper dive into how Visa’s CEDP works and what it means for your business, visit our CEDP Overview.

Why Data Matters: Reducing B2B Commercial Card Costs with Boost

The next time you receive a request to accept commercial card or virtual card, understand that you have options to optimize the cost of acceptance. Boost helps suppliers qualify for the lowest publicly available rates by automatically passing through the enhanced data required by each card network. This data optimization translates directly into lower fees and stronger margins on every commercial card payment.

Qualified Visa rates apply to verified merchants under the Commercial Enhanced Data Program (CEDP); unverified merchants may receive adjusted rates after 20–90 days. Unlike other providers who delay rate adjustments until Visa’s verification cycle is complete, Boost’s pre-funding model* ensures that customers benefit from qualified rates immediately, protecting cash flow and eliminating costly reimbursement delays of up to 90 days. Learn more about Visa’s CEDP rate structure and Boost’s prefunding model here.

If your business is currently accepting commercial card, our Head of AR Solutions, David Bork, recommends a cost savings analysis. “Many suppliers set up merchant accounts years ago with little understanding of how the system works. Boost performs B2B health checks for suppliers all the time and we often find that we can help lower the overall cost of acceptance through optimization and automation”.

With the right data and technology in place, suppliers can take control of their interchange costs instead of accepting them as a fixed expense. Boost automates the data capture process behind the scenes, so every transaction qualifies for the best possible rate without any extra effort from your team.

Ready to find out how much you could save? Contact Boost to schedule a complimentary cost-savings analysis and learn how your transactions can qualify for the best interchange rates under Visa’s CEDP and other network programs.

*Boost will default to the lower CEDP interchange rates at the time of the transaction pending a determination as to whether Supplier qualifies for lower CEDP pricing. If it is determined that Supplier does not qualify for CEDP rates, Supplier will owe to Boost, and Boost is authorized to recoup from Supplier, an amount equal to the difference between the uncollected higher standard interchange rates. See full terms and conditions for additional details.