Mastercard Transforms Its AP Process Worldwide Through Its Partnership with Boost Payment Solutions

Industry Background

Corporations and their banks are looking to financial technology companies to improve B2B payments by curing the pain points associated with traditional payment methods. While check, wire and ACH remain the dominant payment methods in B2B, the landscape is shifting as a greater number of buyers and suppliers are turning to commercial cards. Many of today’s trading partners see cards as better-suited to complement complex trading terms. Virtual cards are quickly becoming the preferred method of commercial card issuance and acceptance. The rapidly accelerated need for digital solutions has driven significant increases in adoptions over the last two years and is expected to grow by more than 300% by 2026.

Executive Summary

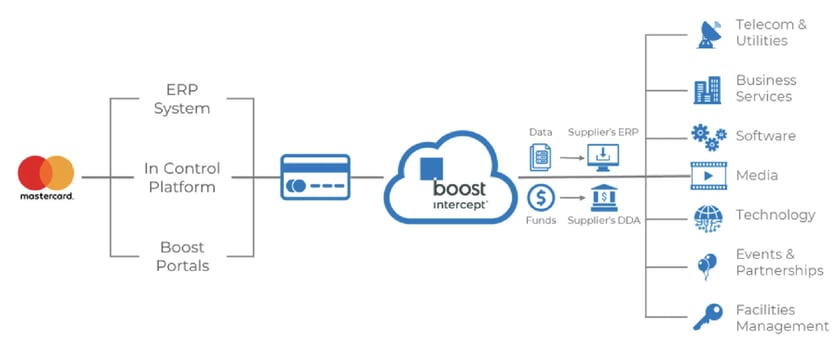

Mastercard enlisted Boost to simplify its payments to suppliers via Boost’s proprietary straight-through processing (STP) platform, Boost Intercept®, thereby allowing Mastercard to automate supplier onboarding, payment processing and remittance reporting.

Boost Intercept digitizes Mastercard’s commercial card payments so that payments are automatically settled with the supplier’s depository banks while payment notifications and detailed remittance reports are sent to suppliers in their preferred file format. By integrating Boost Intercept with Mastercard’s virtual card platform, In Control®, Boost was able to convert the e-mail-based output from In Control into STP payments across the globe using locally issued card products with a single push of a button.

Benefits of STP with Boost Intercept

To make paying suppliers easier and to reap the benefits of using its commercial card platform, Mastercard needed to migrate its supplier network onto cards. To do so, Mastercard’s procurement team, led by Mr. Josh McNally, introduced its suppliers to Boost Intercept, which made card acceptance and remittance reporting a completely passive and simple experience for both parties.

By using commercial cards, Mastercard receives cash-back rebates and significantly expands its working capital. Mastercard is also able to leverage Boost’s international capabilities by expediting international and cross border payments as easily as domestic ones.

- Completely digital process

- Eliminate manual data entry errors

- Incremental revenue via Buyer rebates

- Easy cross border and international settlement

- Guarantee timely and accurate payments

- Increase working capital

- Optimize cost of acceptance

- Actionable insights with enhanced reporting

- Increased protection against attempted fraud

- PCI data is never exposed to the supplier

Simplified Enrollment

Recurring Rebates

Working Capital

International Footprint

About Mastercard

@MastercardNews

@Mastercard

@MastercardWorldwide

About Boost

@BoostB2B

@Boost Payment Solutions