SIMPLER, SMARTER, SAFER B2B PAYMENT ACCEPTANCE

Accepting commercial cards with Boost enables you to get paid quicker and easier with a fully automated processing solution

Streamlined global payments

Bridging the B2B payment gap for trading partners around the world

Use your locally-issued commercial card to pay any supplier within our extensive global network

Maximize card spend

Pay any supplier with your static or virtual commercial card

End-to-end automation

Make card acceptance easy with 100% straight-through processing

Expand working capital

Extend your days payable outstanding with grace periods

Increase supplier acceptance

Best-in-class supplier enablement program at no extra cost

Protect against fraud

Straight-through processing is the safest option for B2B payments

No technical integration

Get started quickly and easily with no tech investment

Create proven value for your business with digital B2B payment solutions

It's anticipated that the global value of B2B virtual card transactions will reach $4.8 trillion in 2026

of CFOs say that payment digitization improved their working capital

of financial institutions are currently working on or plan to work on virtual card solutions for their corporate customers

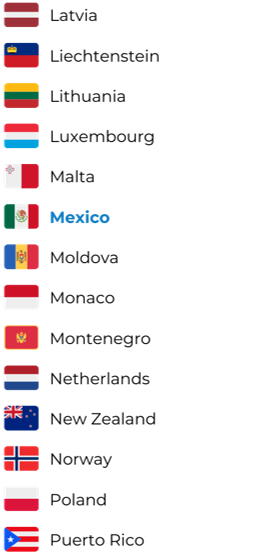

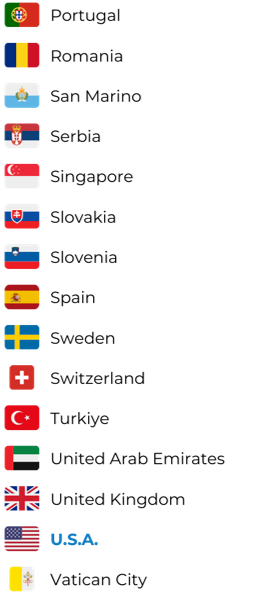

Use your locally-issued card within our global processing network of 55+ countries and territories

CUSTOMER TESTIMONIAL

"Boost's technology is ground-breaking and has reinvented how commercial card payments are initiated, received and processed."

Richard CiamiloVice President of New Markets, Mastercard

A closer look at straight-through processing (STP) with Boost Intercept

Make card acceptance easy with 100% straight-through processing (STP)

- Improve cash flow for you and your suppliers

- Eliminate manual workflows

- Optimize the cost of acceptance

- Provide actionable data and insights

- Improve data security and reduce fraud

We have existing integrations with all major commercial card issuers

.png?width=300&name=NBC%20(CA).png)

.png?width=300&name=Scotia%20(CA).png)

Stay ahead of the curve with the latest global B2B insights from Boost

TOUCH

STATE OF B2B PAYMENTS