What is a Virtual Card?

Virtual credit cards are a flexible electronic payment method using 16-digit credit card numbers typically created for purchases at set amounts. Most commonly sent via email, they offer convenience, security, and speed in the B2B payments space. Virtual cards can improve accounts payable (AP) processes, benefitting both buyers and suppliers by streamlining day-to-day payments, and providing greater control over cash flows. They also offer more safeguards against fraud than traditional business credit cards.

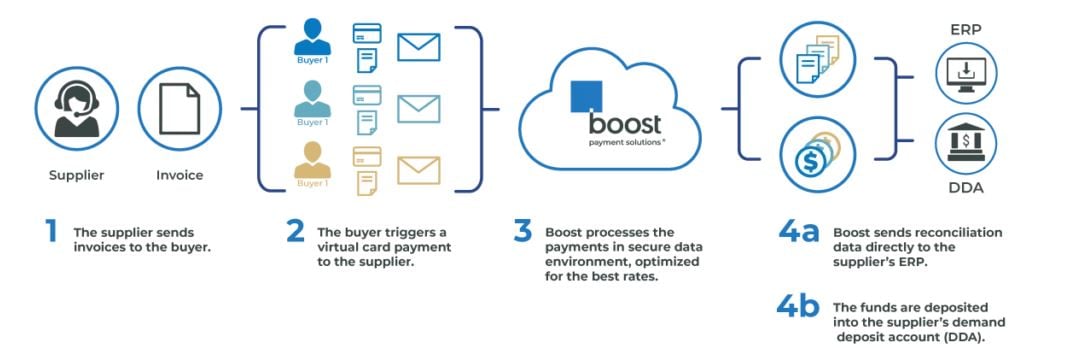

Boost processes virtual cards in an automated way, eliminating manual processing steps.

What are the costs for card acceptance through Boost?

Boost offers the lowest possible business to business card acceptance fees. Boost’s rates are available here.

I am already signed up with Boost, how do I get started?

Getting started is easy. If you are already a Boost customer, just email us at inquiries@boostb2b.com or contact us using the form on this page and let us know the customer that you want to accept payments from via your Boost account. We’ll then verify and confirm your account information, and begin automating your payments. No further action is needed on your part.

What type of reporting is available?

Boost provides enhanced reporting with full remittance and settlement details. Reports are available in a CSV format or in the format of your accounting software and can be selected with the help of our customer service team after enrollment.

Does Boost alleviate PCI compliance concerns?

Yes. Boost suppliers are never exposed to 16-digit card numbers. All live card data is encrypted and tokenized and the supplier (and Boost) are never exposed to it. Only the last four digits of the card numbers are shared with the supplier for tracking purposes. Consequently, as card data is not shared with the supplier, the supplier is not beholden to PCI compliance requirements for the payments that Boost processes.

Do I need a credit card terminal or portal to receive payments from Boost?

No, the funding process is completely automatic, and the transactions will qualify at the lowest published B2B interchange rates. Virtual cards from your customers are automatically processed by Boost and the funds are deposited directly into your preferred bank account by Boost.

Are there any terminal limits or maximum payment amounts?

Transactions through Boost will not be delayed, regardless of transaction size. Boost processes multi-million dollar card payments almost every day. Boost processes the virtual card payments for Fortune 100 companies and thousands of smaller companies, too.

How long will it take to get funds into my bank account?

From the time when your customer sends the virtual card for payment, the funds will typically be in your bank account within 24 – 72 business hours depending upon the bank-to-bank relationships between Boost’s funding bank and your bank.

How long does it take for my Boost account to be transaction ready, once I complete the Boost application?

Once the application is completed, it will take five to seven business days for account set up. The Boost customer service group would typically reach out if there are any questions about the information provided or if any required information is missing.

Would I have any charges from any current acquirer or processor that I use for the payments that Boost processes for my company?

No, these payments would be processed by Boost and there will be no fees from any other processor that you use. You would not be paying two sets of card fees.

Are there any other costs for Boost's payment processing beyond the per transaction fees?

There are no monthly or other charges beyond the per-transaction fees. If there are no payments processed by Boost in a given month, there will be no charges from Boost for that month. There is no long-term commitment to use Boost – you can use your Boost account when you want and you are free to switch processors at any time.

How long does it take for my Boost account to be transaction ready, once I complete the Boost application?

Once the application is completed, it will take five to seven business days for account set up. The Boost customer service group would typically reach out if there are any questions about the information provided or if any required information is missing.

Why does Boost need a voided check or bank letter on Bank letterhead to open my Boost account?

Boost will need either a voided check or a bank letter on bank letterhead that provides the bank account details for funding so we can deposit the funds into your preferred bank account. We cannot accept banking information on the company’s own letterhead. This is required to meet Anti-Money Laundering (AML)/ Know Your Customer (KYC)/ Financial Crimes Reporting Network (FINCEN) regulations. The voided check or bank information on bank letterhead should be scanned and saved as a PDF file and emailed to registration@boostb2b.com.

Why does Boost need beneficial ownership information to set up a Boost account?

Publicly traded companies are not required to provide beneficial ownership information, but the ticker symbol for the company must be provided. Most companies are privately held (meaning they are not listed on a major stock exchange) and will need to complete some additional fields in the Boost application including providing a social security number, birth date and an address (as provided on a driver’s license) for a beneficial owner or control manager. Boost Payment Solutions partners with regulated financial services institutions and, as such, we are required to obtain this information from all privately held companies to comply with Anti-Money Laundering (AML)/ Know Your Customer (KYC)/ Financial Crimes Reporting requirements via the Bank Secrecy Act, USA Patriot Act, and Financial Crimes Enforcement Network (FINCEN) regulations. To confirm, this information is not used for any purpose by Boost other than to meet federal regulations. These regulations apply to the set up of all merchant processing accounts and any new merchant processing or bank account will require the same information to be provided. In fact, any company that has opened any merchant processing or bank account since May 11, 2018 would have been required to provide this information.

Most companies elect to provide the information required from a “control manager” rather than a beneficial owner, which is sometimes difficult to capture. A control manager can be a manager in the company’s accounting or finance group.

Here are a few links that explain why Boost is required to obtain this information:

https://www.fincen.gov/news/news-releases/fincen-reminds-financial-institutions-cdd-rule-becomes-effective-today

https://www.fincen.gov/sites/default/files/2018-04/FinCEN_Guidance_CDD_FAQ_FINAL_508_2.pdf

Boost maintains strict protocols for information and data security as well as confidentiality and privacy. As noted above, we are subject to FINCEN (Financial Crimes Enforcement Network) and Anti-Money Laundering rules and are required to maintain specific PII (Personal Identifiable Information) as per government mandate.

We hope you understand our requirement to gather this information and will complete the fields in the application so we can complete the setup of your Boost account.

Simplified Reconciliation

Enhanced automated remittance provided with email notifications

Simplified Reconciliation

Enhanced automated remittance provided with email notifications

Automated Payment Processing

Payments are direct deposited to your bank account with no manual work

Automated Payment Processing

Payments are direct deposited to your bank account with no manual work