State of B2B Payments: Asia Pacific

Overview

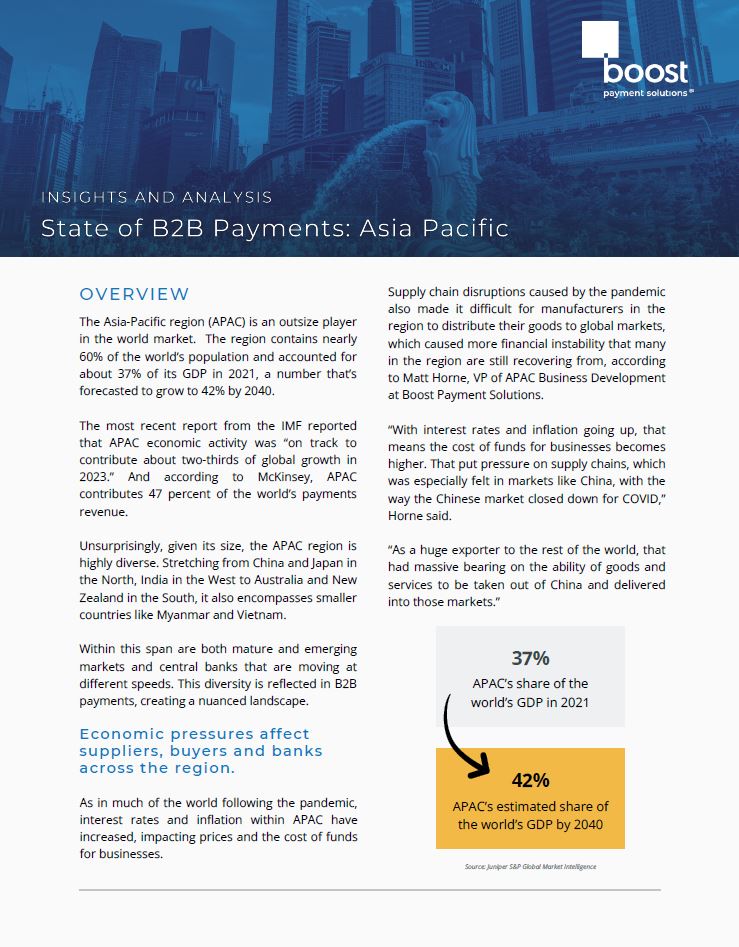

The Asia-Pacific region (APAC) is an outsize player in the world market. The region contains nearly 60% of the world’s population and accounted for about 37% of its GDP in 2021, a number that’s forecasted to grow to 42% by 2040.

The most recent report from the IMF reported that APAC economic activity was “on track to contribute about two-thirds of global growth in 2023.” And according to McKinsey, APAC contributes 47 percent of the world’s payments revenue.

Unsurprisingly, given its size, the APAC region is highly diverse. Stretching from China and Japan in the North, India in the West to Australia and New Zealand in the South, it also encompasses smaller countries like Myanmar and Vietnam.

Within this span are both mature and emerging markets and central banks that are moving at different speeds. This diversity is reflected in B2B payments, creating a nuanced landscape.

Economic pressures affect suppliers, buyers and banks across the region.

As in much of the world following the pandemic, interest rates and inflation within APAC have increased, impacting prices and the cost of funds for businesses.

Supply chain disruptions caused by the pandemic also made it difficult for manufacturers in the region to distribute their goods to global markets, which caused more financial instability that many in the region are still recovering from, according to Matt Horne, VP of APAC Business Development at Boost Payment Solutions.

“With interest rates and inflation going up, that means the cost of funds for businesses becomes higher. That put pressure on supply chains, which was especially felt in markets like China, with the way the Chinese market closed down for COVID,” Horne said.

“As a huge exporter to the rest of the world, that had massive bearing on the ability of goods and services to be taken out of China and delivered into those markets.”

These tight economic conditions contribute to a tension between buyers and suppliers, Horne said. Buyers are trying to extend their payment terms and hold onto their cash as long as they can. Suppliers want to speed up payments so they can better manage their own cash flow.

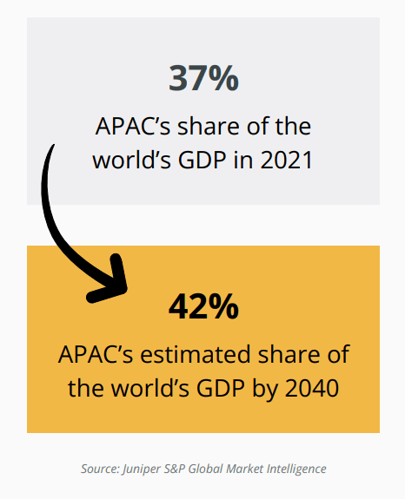

In an Atradius survey of companies in Asia, suppliers reported granting longer payment terms to their customers to help them manage their cash flow. More than half (53%) of respondents said it was taking longer to be paid for overdue invoices.

“The imbalance in financial outcome between buyer and supplier has become very acute,” Horne said.

“One positive of the post-COVID cash flow crunch is that buyers are prepared to share the transaction cost with key suppliers, acknowledging the joint benefit of using commercial cards for invoice payments.”

Local regulation and differences in market maturity create a fragmented payments market.

Some central banks across the region welcome and encourage foreign companies to do business there, while others have more restrictions and requirements. This variation contributes to regional fragmentation, Horne said.

Within individual countries, electronic funds transfer is the predominant means of B2B payments in most of the markets. There is still cash flowing around emerging markets as well.

The region is also brimming with domestic real-time settlement systems—such as India’s United Payments Interface (UPI), Singapore’s FAST service and Australia’s New Payments Platform (NPP).

The 2023 Global Payments Report from Worldpay by FIS described the APAC region as “a global leader in real-time payments – not just in the proliferation of RTP schemes but also in cooperation among the central banks that developed them.”

The report pointed out that some clusters of countries in Asia are linking their real-time payments systems together. Enabling cross-border payments is critical within APAC because there are so many individual markets within this one region. This cooperation helps reduce overhead for businesses that are trading across those markets.

“Two speed region”: In a fragmented environment, advances in technology make the case for digitization.

APAC is essentially a two-speed region. Its mature markets, like Australia, Singapore and Hong Kong, are huge global business hubs that have electronic payments as part of their nature, with real-time payments for consumers as the accepted norm,” Horne said.

In the region’s emerging markets like Vietnam, business processes are still very manual and there’s a lot of cash moving around in the economy.

However, in the emerging countries, mobile phone technology is enabling great leaps to more efficient forms of money movement. In Southeast Asia, for example, the number of smartphone users increased from 498 million in 2017 to 675 million in 2022, which represents 82% of the population there. This has enabled new payment methods such as QR codes and digital wallets to flourish.

“Emerging markets are not taking the 20-year cycles that mature markets have taken to get to where they are,” Horne said.

Across the region, businesses are increasingly interested in new technology either to reduce risk or just improve processes. Markets that are used to using commercial cards in spaces like travel (T&E) and purchasing are now making leaps into single-use virtual cards.

A study conducted for Visa found that more than half (54%) of businesses that already use purchasing cards are interested in using virtual cards.

At the same time, newer fintech and payment providers on the scene are complementing traditional bank services with innovative new functionality. The use of APIs to connect disparate systems—which enables legacy players to partner with newer organizations—is becoming more and more widespread, Horne said.

In B2B payments, these new tools and partnerships enable businesses to streamline and automate their payments. Companies can work with providers like Boost Payment Solutions to create integrated processes that take advantage of the benefits of commercial card payments.

This means that even smaller businesses are now capable of delivering experiences that rival those of larger corporations, thanks to features like automated reconciliation, improved data access, detailed reporting, and enhanced efficiency and speed.

And, both sides of the trading relationship benefit from improved cash flow with faster payment for suppliers and longer terms for buyers.

Providers like Boost Payment Solutions automates the entire payment process from beginning to end, eliminating the need for the supplier to manage individual card payments or manually enter data and reconcile payments to the invoices that are being paid. For suppliers, with straight-through processing from Boost Intercept®, suppliers are able to streamline the expensive manual processes associated with taking B2B payments. Suppliers who accept cards through Boost receive end-to-end automation and superior remittance reporting.

Boost also provides buyers with an effective solution to managing their cash flow through their payment solution Boost 100®. Buyers can keep adequate cash on hand for short-term needs while maintaining solid relationships with suppliers by making timely payments.

Conclusion

Businesses will always adopt change more slowly, led by technology enhancements for consumers. But advances in technology are changing the face of B2B payments within APAC.

More innovation—addressing the nuances of APAC markets and improving cross-border payment flows—means that existing players have an opportunity to meet the moment. Incremental gains in technology are adding to the value that digital payments offer in allowing businesses to streamline their processes and meet their financial goals.

While the APAC region is fragmented, there is tremendous opportunity for innovation and technology solutions to support the digitization of B2B payments.

About Boost

Boost Payment Solutions is the global leader in B2B payments with a technology platform that seamlessly serves the needs of today's commercial trading partners. Our proprietary technology solutions bridge the needs of buyers and suppliers around the world, eliminating friction and delivering process efficiency, payment security, data insights and revenue optimization.

Boost was founded in 2009 and operates in 45 countries and territories around the world.