STATE OF B2B PAYMENTS: EUROPE

OVERVIEW

Among consumers in Europe, preferred payment methods vary widely. From credit cards in France to account-to-account payments in Denmark and Poland, each country has

its own favorite way to pay. B2B payments, however, are a different story.

One payment type—bank transfers—heavily dominates B2B payments across the region. And thanks to the Single Euro Payments Area (SEPA), cross-border payments between European countries can be made as quickly and easily as domestic ones.

In many ways, the current B2B payment system is efficient and effective. But changing economic conditions, the inevitable tension between buyers and suppliers, and a need for more streamlined processes still leave room for innovative solutions in this market.

Payments are fast, but operations lag.

Unlike the U.S., where buyers have long relied on paper checks to pay their suppliers, Europe has taken advantage of electronic money movement for decades. Bank transfers are an easy way to move funds both domestically and across borders, says Rene Stynen, SVP, EMEA Business Development at Boost Payment Solutions.

“It’s really very easy to make a payment from Norway to Greece. It works like a domestic payment. As long as you have the right bank account information, you can wire money to other countries within that SEPA region,” he said.

However, this payment system isn’t without its downsides, he said. For example, B2B bank transfer fees can be costly. These payments also carry a risk of fraud because the supplier must share account details with the buyer. The buyer then also must keep supplier account information up to date, which can be a cumbersome process.

Finally, many businesses do not have their payments integrated with their accounting systems. This means that manual reconciliation is still required.

Cash flow concerns put pressure on both sides of the trading relationship.

In an Atradius survey of businesses in western Europe, respondents said that economic conditions such as inflation and higher costs of funds were having a negative impact on them.

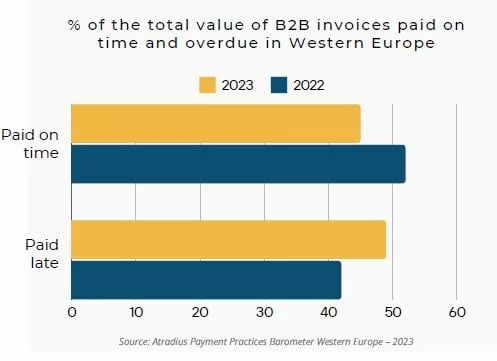

Many businesses reported finding it difficult to pay their bills at all. In fact, nearly half (49%) of the total value of B2B payments were paid late,

while only 45% were paid on time.

A separate survey by Intrum found that 37% of businesses in Europe pay their suppliers later than they would accept payments themselves. And more than half of European businesses said they would like to pay invoices faster but didn’t feel doing so was currently feasible.

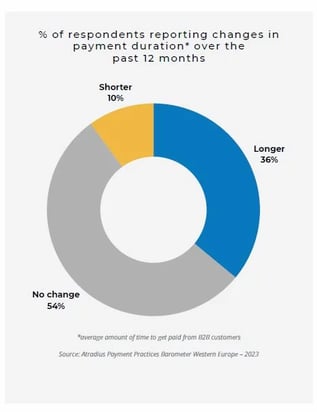

Businesses are coping with this uncertainty by focusing on their working capital. This means that buyers are trying to extend their terms so they can keep their cash available longer. Suppliers, on the other hand, want to get paid as quickly as possible.

Against this economic backdrop, a case for increased commercial card usage is growing.

Historically, card use for B2B transactions in Europe has been limited, Stynen said.

Usage has been driven by buyers, who were looking to take advantage of rebates or trying to extend their payment terms. But because suppliers were footing the bill by paying card transaction fees, they were less likely to agree to accept cards.

Now, however, the case for card usage is expanding while some barriers decline.

A need for flexible cash flow solutions is emerging.

As businesses on both sides of the trading partnership respond to the economic uncertainty, they’re seeking better solutions. Globally, 94% of companies report taking some kind of action to minimize the impact of inflation on their businesses.

Rising interest rates have made loans more costly. Some suppliers are finding that accepting credit cards can be less expensive than bank loans and more flexible than other available solutions such as invoice factoring.

For their part, buyers are continuing to find the use of credit cards an effective way to get credit. To that end, they’re looking to increase card acceptance among their suppliers and are willing to help make it more attractive to them.

“Buyers looking to increase terms with their supplier base are offering card payment as a mitigating tool. So the supplier has a choice: accept a longer term, or accept cards at the same or reduced term,” Stynen said.

“Buyers are also looking to expand their DPO (days payable outstanding) using card payments. So they’re working out an arrangement with the supplier to offset part of the card fees.”

These sorts of arrangements are helping card payments to offer more benefits for both parties, Stynen said.

Legacy processes are giving way to improved technology.

Newer and nimbler payments partners have also started taking advantage of improved technology to automate and streamline previously clunky card-related processes.

In response to strict AML and KYC requirements, legacy providers had developed onboarding and underwriting procedures that are both time and labor-intensive. As a result, suppliers were often reluctant to jump through the hoops that were required to accept cards, Stynen said.

Newer entrants have found ways to meet requirements that keep the payments system safe and secure with processes that are faster and easier for suppliers. For example, companies like Boost can automate the payment process from beginning to end, a solution known as straight-through processing (STP).

STP has also emerged as an efficient way of dealing with B2B virtual card payments for suppliers that do not currently accept cards and those that want to cut out their operational involvement in card processing,” Stynen said.

STP providers sit between the buyer, the supplier and the financial institutions. Suppliers integrate their enterprise resource planning (ERP) software

with the STP provider’s platform.

Then, when a buyer pays an invoice with a virtual card, the provider pushes the funds along with the associated data and reporting to the supplier.

The entire payment process is automated from beginning to end, eliminating the need for the supplier to manage individual card payments or manually enter data and reconcile payments to the invoices that are being paid. For suppliers, with straight-through processing from Boost Intercept®, suppliers are able to streamline the expensive manual processes associated with taking B2B payments. Suppliers who accept cards through Boost receive end-to-end automation and superior remittance reporting.

Boost also provides buyers with an effective solution to managing their cash flow through their payment solution Boost 100®. Buyers can keep adequate cash on hand for short-term needs while maintaining solid relationships with suppliers by making timely payments.

CONCLUSION

European businesses enjoy an efficient and cost-effective payments system that works smoothly both domestically and across borders.

But an uncertain economy is driving many businesses to seek ways to improve their cash flow. At the same time, technology and automation are reducing the need for inefficient operational processes.

This means that businesses are exploring new

and emerging solutions that enable them to

better take advantage of payments options and

meet more of their financial goals.

ABOUT BOOST PAYMENT SOLUTIONS

Boost Payment Solutions is the global leader in B2B payments with a technology platform that seamlessly serves the needs of today’s commercial trading partners. Our proprietary technology solutions bridge the needs of buyers and suppliers around the world, eliminating friction and delivering process efficiency, payment security, data insights and revenue optimization.

Boost was founded in 2009 and operates in 45 countries and territories around the world.

@BoostB2B

@Boost Payment Solutions

CONTACT

For more information about this whitepaper, please contact

Rene Stynen

SVP of EMEA Business Development

RStynen@boostb2b.com